Your Catalyst for

Business Growth

Our mission is empowering business owners to focus on what matters most by providing education, advisement, and professional financial services designed to allow our clients to achieve growth, prosperity, sustainability, and financial peace of mind. BeanLab’s Catalyst Program is a comprehensive and strategic approach to your growing business’ financial service needs through holistic and growth-minded accounting, advisory, payroll, and tax.

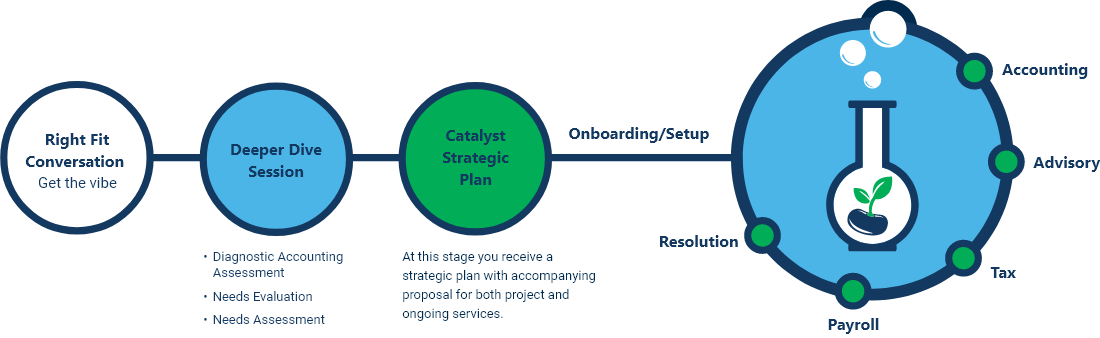

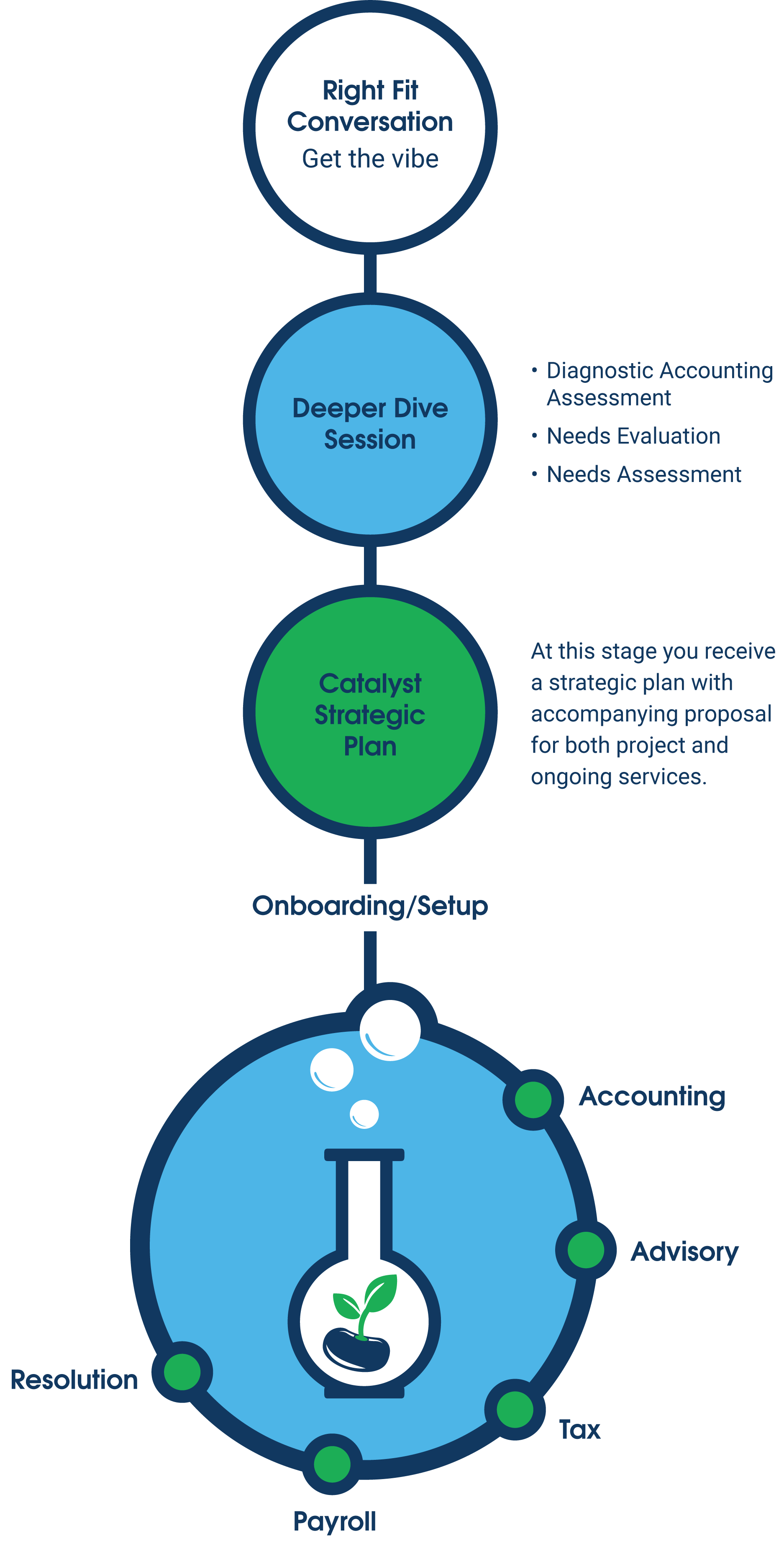

BeanLab’s Catalyst Process

Accounting & Advisory

BeanLab is proud to offer strategic accounting & bookkeeping services focused on discovering growth opportunities. Organizations nurturing long-term visions mature gracefully with year-round accounting partnerships.

Our advice can increase cash flow and profits, allowing your company the opportunity to map out growth strategies. BeanLab’s diagnostic accounting assessments lead to accounting solutions that ensure a legacy of success and profitability.

- Bookkeeping

- Accounting Review

- Accounts Payable Management

- QuickBooks Clean-up

- Bookkeeping

- Accounting Review

- Accounts Payable Management

- QuickBooks Clean-up

Payroll

BeanLab’s payroll experience is on your side, ready to assist with a variety of payroll-related issues, from expanding into different states to employee participation in benefits.

- Pay your people and file taxes effortlessly.

- Payroll and payroll tax filing

- Payroll Tax and Compliance

- Manage your team with confidence.

- Human Resources

- Talent Management

- Time and Labor Management

- Provide better benefits and insurance to everyone.

- Benefits Administration

- Health Care Reform Management

- Retirement Accounts

- Business Insurance

- Time and Labor Management

- Provide better benefits and insurance to everyone.

- Benefits Administration

- Health Care Reform Management

- Retirement Accounts

- Business Insurance

Tax

BeanLab’s tax team becomes intimately familiar with our client’s business throughout the year. Once assigned to your organization, we handle your accounting needs, such as annual tax preparation, sales tax filings, and quarterly tax estimates.

- Tax preparation for S-corporations, C-corporations, Partnerships, and Limited Liability Companies.

- Proactive Corporation and Small Business Tax Planning.

- Entity Consulting and Selection.

- Quarterly Tax Estimates.

- Sales Tax Filings.

- Individual Taxes for Business Owners.

- Quarterly Tax Estimates.

- Sales Tax Filings.

- Individual Taxes for Business Owners.